CREDIT INSURANCE

CREDIT INSURANCE

Credit insurance is part of the division dedicated to finding the most suitable solution to meet the needs of businesses, from the more structured enterprises with high turnover through to SMEs. Credit insurance coverage relates to the risk of non-payment of short-term trade receivables deriving from domestic market and export business relationships. Clearly, this policy concerns a type of insurance cover with particular characteristics, and therefore requires intermediaries specialized in specific management.

Contact us now for a dedicated consultation.

THE SOLUTIONS WE OFFER

TRADITIONAL TURNOVER POLICY

This is a system that integrates services and insurance coverage to support the company in the credit management phases, protecting both current and future cash flow and profits.

The "traditional" policy allows the insured company to benefit from three different services under the same contract:

- pre-assessment and monitoring of debtors

- insolvency insurance

- a credit recovery service

SINGLE RISK EXPORT POLICY

The Single Risk Export Policy allows the Company to cover even a single foreign buyer, or a limited number of foreign buyers (maximum 10-15), for both spot supplies and revolving supplies. It is possible to request the combined coverage of political and commercial risks, or the isolated coverage of commercial risks only.

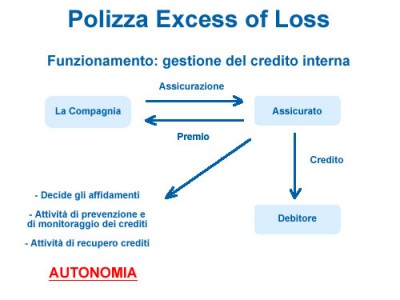

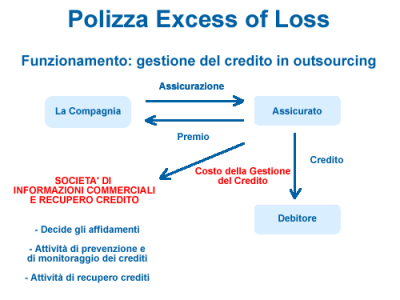

EXCESS OF LOSS POLICY

The Excess of Loss Policy is designed for medium to large companies that require insurance coverage to protect the company's balance sheet against events of an exceptional nature and frequency. The policy does not provide for the granting of credit lines, a maximum level of compensation is purchased which is established according need, while short-term and structural losses remain the responsibility of the Insured by virtue of the global annual deductible and the deductible per claim.

In the event that the Insured has a Credit Policy of proven reliability – it is not required to be certified in the quality model – it might be possible to maintain internal credit management internally. In this way, the customer portfolio, in particular in the phases of assignment, recovery and litigation, could be precisely managed without changing existing procedures and commercial practices.

If, on the other hand, the Insured does not have a Credit Policy, it is possible to outsource some activities to the Partners such as, for example, the assignment and monitoring of the customer base and possibly also the recovery of credit already in the out-of-court phase. In short, it is necessary that these Partners support the Insured in credit management, in relation to the normal functions that would normally fall under the responsibility of a "traditional" credit insurer.

TOP UP POLICY (II RISK)

The Top Up Policy (II Risk) allows the insured company to add an additional ceiling to the coverage of the traditional policy to be used for exposures not fully guaranteed.

BOND

Asigest Broker searches the market for the best insurance guarantees from the main companies, both for public and private beneficiaries, identifying the most suitable solutions to meet the needs of the customer.

Choosing a surety or security guarantee has particular advantages. Primarily, the possibility of using an instrument accepted by all beneficiaries, as well as the maintenance of the contractor's financial standing, since it is neither necessary to immobilize money, securities or other collateral, nor to complete a plethora of agreements with the banks.

In detail:

- Public tenders: these guarantee participation in tenders and good execution of works

- Customs: deferred periodic payment, temporary imports and other customs operations

- Building permits: urbanization and public concessions

- Deposits for Duties and Taxes: VAT refunds, Personal Income Tax

- Guarantees for activities carried out abroad

- Deposits for Ministerial and Regional Authorizations: waste disposal and registration in the disposal register

- Contracts between private individuals: exchanges, orders for supplies and subcontracts.

CONTACT US

For more information regarding the services that we offer, please contact us using the form below. We will be happy to respond to any request for further information.